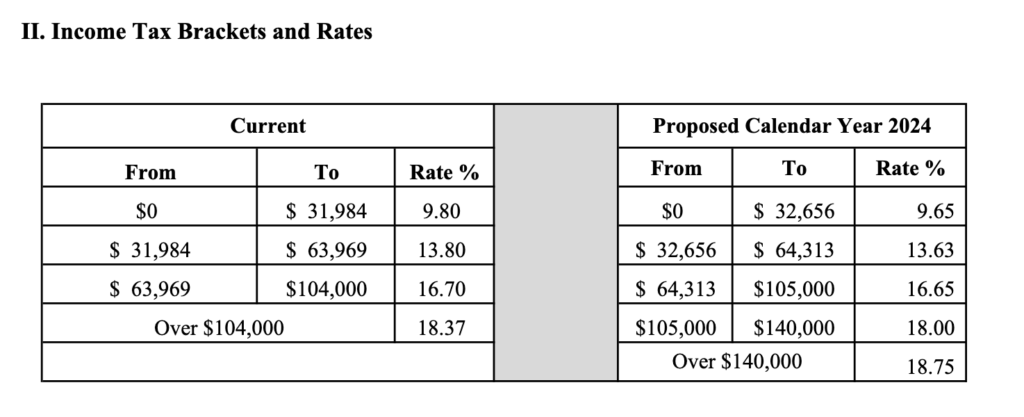

On May 26th, the PEI government announced income tax changes to take effect over the next two years. Two changes stand out that won’t take effect until the 2024 tax year:

- Increasing the tax bracket thresholds

- Reducing tax rates on lower brackets.

One has to dig deeply to find the actual changes being proposed:

What does this mean in practice? Ignoring tax credits like the basic personal amount (which is also changing), we can calculate the expected tax payable today to the province for an income of $60,000 annually as follows:

- On income from $0 to $31,984, the provincial tax rate is 9.80%. Since the total income is $60,000, this entire tax bracket applies, and the tax owing is 9.80% * $31,984 = $3,134.43.

- On income from $31,984 to $63,969, the provincial tax rate is 13.80%. Since the total income is $60,000, only part of this tax bracket applies, and the tax owing on the amount remaining is 13.80% * ($60,000 – $31,984) = 13.80% * $28,016 = $3,866.21.

- Since the total income is $60,000, neither the tax brackets from $63,969 to $104,000 nor the tax bracket above $104,000 applies.

- The total tax owing is thus $3,134.43 + $3,866.21 = $7,000.64.

What changes in 2024? Using the new tax brackets for 2024, we can calculate using the new tax brackets:

- On income from $0 to $32,656, the provincial tax rate is 9.65%. Since the total income is $60,000, this entire tax bracket applies, and the tax owing is 9.65% * $32,656 = $3,151.30.

- On income from $32,656 to $64,313, the provincial tax rate is 13.63%. Sinec hte total income is $60,000, only part of this bracket applies, and the tax owing on the amount remaining is 13.63% * ($60,000 – $32,656) = $27,344 = $3,726.99

- Since the total income is $60,000, none the remaining tax brackets apply.

- The total tax owing is thus $3,151.30 + $3,726.99 = $6,878.29.

After all is said and done, a person earning $60,000 annually will now pay $7,000.64 – $6,878.29 = $122.35 less taxes to the provincial government in 2024 than they would have in 2023. Instead of paying 11.7% of your income to the provincial government, you’re now only paying 11.5% — a savings of two tenths of a percent.

Time to celebrate? Unfortunately, not really. Unlike the federal government and most other provinces, PEI doesn’t index their provincial taxes to inflation. The purchasing power of that $60,000 annual salary changes drastically in the face of higher rents, more expensive groceries, and pricier fuel. Statistics Canada quantified this change in 2022:

The Consumer Price Index (CPI) rose 6.8% on an annual average basis in 2022, following gains of 3.4% in 2021 and of 0.7% in 2020.

If the CPI is an accurate average of the price increases most islanders face — it’s not, but that a separate debate! — then that $60,000 can now only afford $56,603 in goods and services. Saving $122.35 in face of a $3,397 shortfall is hardly a reason to celebrate.

Two closing thoughts. First, that $122.35 doesn’t come for free — notice the new tax bracket for those earning over $140,000? They now pay 18.75% for income above that threshold, compared to 18.37% before. Whether or not you think that’s fair, consider that these people are in the best position to leave PEI for more competitive tax rates offered by other provinces. Driving away islanders who contribute the most in taxes is not a sustainable plan.

Secondly, these changes will only apply starting in 2024. Inflation hasn’t exactly stopped growing in 2023, so by the time these tax brackets take effect, that remaining $56,603 will be worth even less.

Is there an alternative to all these changes? Yes, but that’s another debate.